Updated on : October 22, 2024

Distributed Antenna System Market Size & Share :

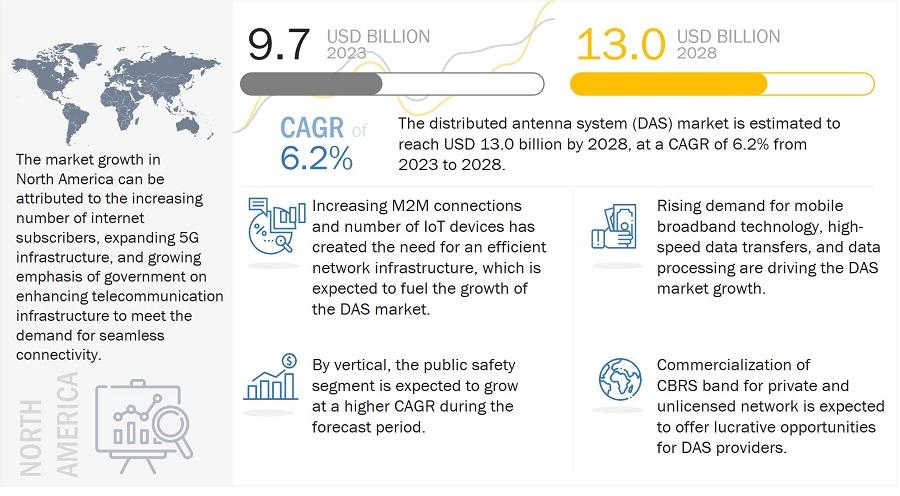

The global Distributed Antenna System Market size is projected to grow from USD 9.7 billion in 2023 to USD 13.0 billion by 2028, growing a CAGR of 6.2% during the forecast period 2023 to 2028

Bạn đang xem: Distributed Antenna System (DAS) Market Size, Share & Growth

The growing mobile data traffic and Growing need for strong and reliable cellular connectivity for Internet of Things (IoT) are expected to propel the DAS market size in the next five years. However, routing backhauling issue associated with DAS networks and complexities associated with installation of DAS are likely to pose challenges for the industry players.

The objective of the report is to define, describe, and forecast the distributed antenna system industry based on offering, coverage, ownership model, vertical, user facility area, frequency protocol, network type, signal sources, and region.

Distributed Antenna System (DAS) Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Distributed Antenna System Market Growth Dynamics

Driver: Rising demand for enhanced network coverage and need to eliminate connectivity gaps in buildings

Mobile device users expect a seamless network for continued connectivity at every location, including stadiums, theaters, malls, railway stations, and airports. Large cell sites and cellular antenna towers deliver wireless reception and transmission across long distances, but dead spots often exist in clusters of buildings or within individual buildings. With their increasing dependence on connectivity, end users cannot afford to have in-building dead zones. DAS alleviate this issue by providing reliable coverage throughout the building.

Although macro cell sites and antennas installed by telecom operators cover most of the venues mentioned above, their coverage is very weak and capacity is low. HetNet solutions, such as small cells, can expand the coverage of mobile networks. However, the deployment process of new cell sites is challenging and costly for mobile operators, and, thus, many operators now prefer DAS to provide seamless connectivity to customers. In addition, DAS aids in ensuring constant communication for end users and emergency responders inside buildings. Also, modern construction processes for many enterprise buildings involve techniques and materials that block wireless communication signal penetration or degrade the quality of received signals. DAS are designed to extend wireless coverage within structures and enable radios and mobile phones to work regardless of their position within the building.

Restraint: Routing backhauling issue associated with DAS networks

The backhaul radio provides a high level of flexibility, as it is claimed that network operators can deploy their DAS anywhere. Although routing backhaul is a problem associated with both DAS and small cell networks, DAS is typically more problematic as each radio head used to broadcast the cellular signal requires routed fiber-optic cables, making the installation process troublesome.

This process can potentially create issues with cable management, as keeping the fiber-optic lines out of sight requires the cables to be carefully routed through the walls and other important structures of the facility. If this process is not conducted correctly, the routing of these cables can adversely affect the facility’s structural integrity, making it unsafe and unfit for visiting patrons.

Opportunities: Increase in commercial spaces across Association of Southeast Asian Nations (ASEAN)

The Association of Southeast Asian Nations (ASEAN) has witnessed a tremendous increase in the number of commercial spaces over the last few years, driven by rapid urbanization and rising middle-class income levels. This also led to the growth in demand for wireless connectivity services in various places such as office and residential buildings, metro stations, subways, airports, and stadiums. According to the World Economic Forum, major Southeast Asian countries, such as Vietnam, Myanmar, and Thailand, have emerged as a low-cost alternative to China for living.

Additionally, the economic growth of the ASEAN region is expected to be beneficial for Singapore as global firms seek to establish their presence in Southeast Asia, with many selecting the country as their regional headquarters. These factors are expected to fuel the requirement for in-building and outdoor wireless services, which would be offered through the deployment of DAS at various sites.

Challenges: Upgradeability issues of existing DAS networks

DAS networks have upgradeability issues when it comes to network advancement. As most carriers are now upgrading to the 5G network, it is more difficult to upgrade an existing DAS network than the upgrade of a comparable small cell network. Typically, small cell networks can be upgraded over the air (OTA) without the need for a technician to visit the cell site. DAS network upgrades, however, may require the replacement of hardware, i.e., base station replacement, making the upgrade process more costly and time-consuming.

Distributed Antenna System Market Analysis :

The Distributed Antenna System (DAS) market is analyzed to be growing significantly due to its critical role in addressing the challenges of wireless communication in densely populated and large-scale environments.This growth is driven by the increasing mobile data traffic and the need for better network coverage and capacity. Key industry sectors, such as telecommunications, healthcare, and hospitality, are heavily investing in DAS to improve connectivity and enhance user experience. Furthermore, the regulatory push for improved public safety communication systems is fostering the adoption of DAS in government buildings and transportation hubs. However, the high cost of installation and maintenance, along with the complexity of integrating DAS with existing networks, poses challenges that could impede market growth.

Distributed Antenna System Market Growth :

The Distributed Antenna System (DAS) market is poised for robust growth, fueled by the escalating demand for improved wireless communication and the expansion of mobile networks. The growth trajectory is supported by technological advancements and the increasing penetration of mobile devices, which necessitate reliable and high-performance network infrastructure. The widespread rollout of 5G technology is a major growth driver, as DAS systems are essential for meeting the coverage and capacity requirements of 5G networks, especially in high-density urban areas and large buildings. Additionally, the rise of remote working and digital transformation across industries is boosting the need for efficient indoor network solutions, further accelerating market growth. To capitalize on this growth, industry players are focusing on strategic partnerships, product innovations, and expanding their geographic presence to cater to the rising global demand for DAS solutions.

Distributed Antenna System Market Trends:

The Distributed Antenna System (DAS) market is experiencing several noteworthy trends driven by the increasing demand for enhanced mobile connectivity and data transmission. One significant trend is the growing adoption of DAS in large public venues such as stadiums, airports, and convention centers, where ensuring reliable and high-capacity wireless coverage is crucial. Additionally, the rise of smart cities and IoT applications is propelling the deployment of DAS to support the extensive network requirements of these advanced infrastructures. Another trend is the integration of DAS with 5G technology, which aims to deliver ultra-fast internet speeds and low latency. As businesses and consumers seek seamless connectivity, the trend towards indoor DAS installations in commercial buildings and residential complexes is also gaining momentum, enhancing indoor coverage and boosting overall network performance.

Commercial Vertical to acquire significant share in DAS market

The commercial vertical is expected to hold the largest market share during the forecast period. DAS deployments are mainly concentrated in the commercial vertical; this vertical accounted for 87.1% share of the overall market in 2022. Different commercial spaces such as public venues, healthcare organizations, enterprises, and educational institutions are witnessing a high demand for DAS due to the increased mobile data traffic and the number of IoT devices. According to a report published by Ericsson Mobility in 2022, the total mobile data traffic for all devices is expected to increase by four times during the forecast period, reaching ~453 exabytes (EB) per month by 2028.

Service offering to command largest share in DAS market

Xem thêm : 100+ Hình xăm nửa lưng đẹp nhất năm 2024

The service segment accounted for the largest market share in 2022. It is further expected to dominate the market during the forecast period, growing at a higher CAGR between 2023 and 2028. Installation services contribute significantly to the overall growth of the DAS market. Both DAS manufacturers and DAS integrators offer installation services. Major installation services include equipment ordering; cable installation; equipment pre-staging and configuration; installation of the head-end and remote equipment; and coordination with wireless service providers for design approval, rebroadcast agreements, and commissioning (system activation).

Distributed Antenna System Market Regional Analysis:

DAS market to witness highest demand from Asia Pacific

China held the largest share of the DAS market size in Asia Pacific for services and components in 2022 and is projected to dominate both markets during the forecast period. Telecom operators and internet providers such as Tencent (China), Baidu (China), and Alibaba (China) continue with various developments in 5G networks in China. The 4G network is still thriving in the Chinese market, and the country, with the world’s largest population, had an internet usage rate of 65.2% (912 million) of the total population of 1.4 billion as of January 2021 (DataReportal). As of January 2021, China’s mobile web traffic accounted for 61.6% of the total web traffic. With the increasing data traffic, the demand for DAS in China is expected to increase during the forecast period.

The integration of IoT and 5G will help enterprises to manage and scale their IoT businesses from a unified platform. With unprecedented speed and flexibility, 5G transports more data than before, with greater responsiveness and reliability. 5G speeds up cloud services, while AI analyzes and learns from the same data more quickly. AI is required for a fully operational and efficient 5G network. The use of 5G networks allows for the integration of machine learning and AI at the network edge. 5G allows multiple IoT devices to connect at the same time, generating massive amounts of data that must be processed using machine learning and AI. In May 2022, Tencent, the Chinese technology giant, announced an investment of USD 69.9 billion over the next five years in areas ranging from cloud computing to artificial intelligence. It would also back China’s push for “new infrastructure,” a term used by Beijing to refer to technology areas such as artificial intelligence, next-generation mobile networks of 5G, and transportation infrastructure such as electric cars.

Distributed Antenna System (DAS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Distributed Antenna System Companies – Key Market Players:

Major vendors in the distributed antenna system companies include CommScope (US), Corning (US), PBE Axell (UK), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), AT&T (US), Boingo Wireless (US), Dali Wireless (US), Zinwave (US), Whoop Wireless (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Advanced RF Technologies (ADRF) (US), Galtronics (Canada), Connectivity Wireless (US), Betacom (US), among others.

Distributed Antenna System Market Report Scope :

Report Metric

Details

Estimated Market Size USD 9.7 billion in 2023 Projected Market Size USD 13.0 billion by 2028 Growth Rate At A CAGR of 6.2%

Distributed Antenna System Market Size Available for Years

2019-2028

Base Year

2022

Forecast Period

2023-2028

Units

Value (USD Million/USD Billion)

Xem thêm : Chân 23cm đi giày size bao nhiêu?

Segments Covered

- By Offering,

- By Coverage,

- By Ownership Model,

- By User Facility Area,

- By Signal Source,

- By Frequency Protocol,

- By Network Type, and Vertical, and Region

Regions Covered

- North America,

- Europe,

- Asia Pacific, and

- RoW

Companies Covered

CommScope (US), Corning (US), PBE Axell (UK), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), AT&T (US), Boingo Wireless (US), Dali Wireless (US), Zinwave (US), Whoop Wireless (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Advanced RF Technologies (ADRF) (US), Galtronics (Canada), Connectivity Wireless (US), Betacom (US), among others. A total of 25 players are profiled in the report.

Distributed Antenna System (DAS) Market Highlights

This report categorizes the DAS market trends based on component, product, application, vertical, and region.

Segment

Subsegment

By Offering

- Component

- Services

By Coverage

- Indoor

- Outdoor

By Ownership Model

- Carrier ownership

- Neutral-host ownership

- Enterprise ownership

By User Facility Area

- >500 K SQ. FT.

- 200-500 K SQ. FT.

- <200 K SQ. FT.

Distributed Antenna System Market Size By Vertical

- Commercial

- Public Safety

By Frequency Protocol

- Cellular

- VHF/UHF

- Others

Distributed Antenna System Market Size, By Network Type

- Public network

- Private LTE/CBRS

By Signal Source

- Off-air antennas (repeaters)

- On-site base transceiver station (BTS)

- Small cells

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- RoW

- Middle East & Africa

- South America

Recent developments DAS Industry :

- In January 2023, Wilson Electronics acquired Zinwave Communications, a provider of unique, patented ultra-wideband RF over fiber solutions with more than 850 installations in 26 countries. The transaction expanded the total addressable market and opened further opportunities for both organizations internationally.

- In June 2022, Comba Telecom Systems Holdings Limited launched 4G/5G (8TR) Green Integrated Base Station Antenna, which expanded its tower top portfolio to support operators in achieving carbon neutrality targets. To support the low-carbon deployment of 5G networks, Comba Telecom launched a high-end 4G/5G (8TR) integrated Base Station Antenna (BSA), which meets the capacity and coverage requirements, and has become the mainstream tower-top antenna solution for global 5G network construction.

- In December 2022, Boingo Wireless, a leading provider of wireless solutions for the US military, deployed a property-wide Wi-Fi network at the Armed Forces Recreation Center (AFRC) Edelweiss Lodge and Resort located in Germany’s Bavarian Alps. Boingo Wireless designed, installed, and manages the Wi-Fi network throughout the sprawling resort, including rooms, meetings spaces, spa, and restaurants.

- In August 2022, Corning Incorporated expanded manufacturing capacity for optical cables. The new facility is Corning’s latest in a series of investments in fiber and cable manufacturing, totaling more than USD 500 million since 2020. These investments, supported by customer commitments, nearly double Corning’s ability to serve the US cable market and connect more people and communities.

Frequently Asked Questions (FAQ):

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Nguồn: https://leplateau.edu.vn

Danh mục: Kinh Nghiệm

This post was last modified on Tháng mười một 20, 2024 2:01 sáng